Exploring a New Era of Growth in the US Specialty Chemicals Market 2033

Understanding the Current State of the U.S. Specialty Chemicals Market

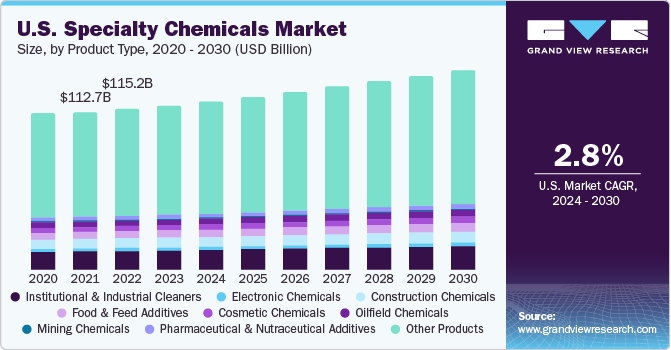

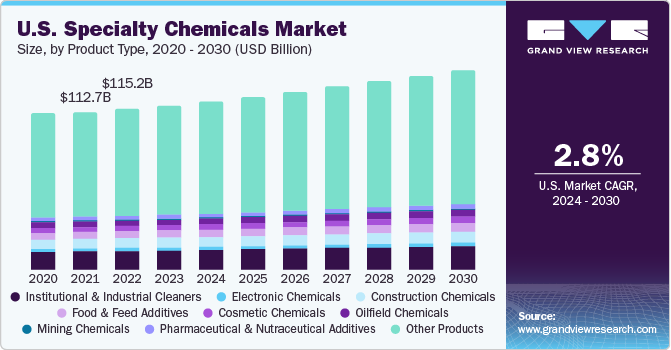

The U.S. specialty chemicals market stands as a testament to America’s innovation in molecular science. Valued at USD 198.41 billion in 2024, the industry is projected to reach approximately USD 260.01 billion by 2033. This growth is underpinned by a compound annual growth rate (CAGR) of about 3.05%, providing a stable yet dynamic outlook for companies and investors alike. The market serves as the hidden backbone behind everything from life-saving pharmaceutical formulations to the high-performance coatings on wind turbine blades, each product designed with spike precision at the molecular level.

The landscape is filled with tricky parts and tangled issues that require careful consideration. From state-level regulatory challenges to supply chain vulnerabilities, the market’s evolution is deeply interwoven with both the breakthroughs in technology and the twists and turns of geopolitical influences. In this editorial, we take a closer look at the various factors shaping this industry, examining both its promising opportunities and the complicated pieces that stand in its way.

Driving Factors and Market Opportunities

Semiconductor Manufacturing Expansion and Advanced Material Demands

One of the most exciting drivers of growth in the U.S. specialty chemicals market is the booming semiconductor manufacturing sector. As the semiconductor industry undergoes a rapid transformation—especially with the re-shoring initiatives under the CHIPS and Science Act—the demand for ultra-high-purity specialty chemicals has surged. These chemicals play a super important role in wafer fabrication, where even the smallest molecule can make all the difference in device performance.

Companies are quickly realizing that meeting the needs of semiconductor production requires a strategic blend of innovation and precision engineering. With the global race to improve chip performance, manufacturers are under pressure to supply chemicals that not only meet stringent purity standards but also deliver consistent performance under high-temperature and high-pressure conditions.

This segment is rife with opportunities for specialty chemical suppliers willing to invest in research and development. The market’s growth here is critical, as it effectively supports and accelerates the progress of technological advancements, driving a ripple effect across various high-tech industries.

Pharmaceutical Innovation and Biologics Production Scaling

The pharmaceutical arena, particularly in the realm of biologics, has significantly influenced the specialty chemicals market. Advanced therapies like monoclonal antibodies, mRNA vaccines, and cell-and-gene therapies have redefined the role of specialty chemicals. Manufacturers are now tasked with delivering materials that meet strict quality and safety parameters—for example, ensuring that single-use bioreactor bags maintain integrity and sterility for extended periods at body temperature.

The importance of having chemicals that can control trace levels of impurities is underscored by recent FDA guidelines. These guidelines require oversight on residual solvents and catalysts at parts-per-billion levels. Such high standards ensure that pharmaceutical products remain safe for consumers, but they also push manufacturers to support their innovation with sophisticated custom-synthesized purification agents.

This convergence of pharmaceutical innovation with chemical precision is creating an ecosystem where specialty chemicals are not just raw inputs but become essential components in driving healthcare breakthroughs.

Tackling Regulatory and Environmental Challenges

Fragmented State-Level Regulations and Compliance Costs

One of the most nerve-racking aspects for specialty chemical manufacturers is the maze of state-specific environmental and safety codes. Unlike a uniform national policy, companies often find themselves contending with a patchwork of regulations that vary widely from one state to another. This uneven regulatory landscape can lead to higher operating costs, as manufacturers must design separate production lines or modify their processes to meet local requirements.

A recent survey by the Society of Chemical Manufacturers and Affiliates illustrated this point well, revealing that 67% of mid-sized specialty producers devote more of their budget to regulatory compliance than they do to research and development. Such a scenario not only strains financial resources but also diverts attention from fostering innovation and accelerating time to market.

Table 1 below summarizes the key challenges stemming from regulatory fragmentation:

| Challenge | Impact on Manufacturers |

|---|---|

| Diverse Emission Standards | Multiple compliance procedures increase operational complexity. |

| Inconsistent Waste Disposal Rules | Necessitates separate waste management strategies, raising costs. |

| Varied Worker Exposure Guidelines | Requires customized safety protocols, impacting production schedules. |

The additional costs and the challenging bits associated with meeting these diverse requirements can stifle innovation as companies are forced to focus on surviving regulatory hurdles rather than pushing the envelope on product development.

Supply Chain Vulnerabilities and Geopolitical Risks

The specialty chemicals industry is no stranger to supply chain disruptions. A significant portion of the raw materials required for specialty chemical synthesis—such as boron, rare earth elements, and high-purity silica—are imported. In fact, statistics reveal that the U.S. sources 100% of its boron, 85% of its rare earth elements, and 78% of its high-purity silica from abroad.

These concentrated global feedstock sources, primarily from countries like China, Russia, and Kazakhstan, expose the industry to geopolitical tensions and trade disruptions. For instance, the Chinese export restriction on boron compounds in 2022 resulted in a 17-month delay for a major U.S. defense contractor’s project, highlighting how easily the supply chain can be thrown off balance.

This reliance on external inputs means that even downstream manufacturing operations—despite their advanced technological capabilities—remain vulnerable. Companies must therefore invest in strategies to mitigate risks through diversification of supply sources, stockpiling of critical feedstocks, or fostering stronger domestic raw material production capacities.

The Digital Revolution: AI and Molecular Design

Artificial Intelligence in Chemical Discovery and Optimization

The transformative impact of artificial intelligence (AI) on the specialty chemicals market cannot be overstated. With the help of advanced algorithms and digital molecular design, companies are now capable of compressing traditional R&D timelines from years to a matter of months. AI-driven platforms can quickly predict thousands of viable chemical structures, screen them for toxicity and thermal stability, and even synthesize promising candidates in record time.

This digital leap is proving to be a super important factor in accelerating product innovation. In one notable instance, a company’s AI algorithm predicted 12,000 potential structures, carefully vetted them, and managed to validate three promising candidates—all within a single fiscal quarter. The application of AI in this realm is not merely a gimmick; it’s a critical enabler in developing tailor-made solutions that can meet the evolving demands of industries like semiconductors and pharmaceuticals.

Some of the distinct benefits of AI-driven discovery include:

- Acceleration of discovery timelines

- Enhanced screening for small distinctions in chemical properties

- Reduction in trial and error in the laboratory

- Support for the creation of high-performance chemicals with specific functional requirements

This development is a signal for industry players to explore digital innovation more deeply, as digital molecular design provides a clear path forward in overcoming traditional R&D challenges while accelerating the market’s overall growth.

Digital Tools and Molecular Precision

Beyond AI-driven discovery, digital tools are increasingly employed to optimize every step of the chemical production process. Digital modeling platforms empower engineers to simulate molecular interactions, fine-tune production processes, and even forecast the environmental impact of various chemical formulations before any physical production begins.

This approach not only minimizes waste and reduces cost but also ensures that each chemical product is crafted with impeccable molecular precision. The digital revolution in chemical manufacturing is a game changer, allowing companies to manage their cheesy trails and figure a path to innovation more confidently amid a landscape riddled with complicated pieces that require careful oversight.

Sustainable Chemistry: Moving Toward Bio-Based Solutions

Adoption of Circular Economy Principles

As the global emphasis on sustainability continues to grow, the specialty chemicals industry is experiencing a similar push towards eco-friendly operations. With the spotlight on reducing environmental impact, many companies are now embracing circular economy practices that focus on recycling, reuse, and efficient resource management.

Sustainable platforms in bio-based and circular chemistry are offering new avenues for growth. By utilizing renewable feedstocks such as plant oils, lignin, and materials derived from microbial fermentation, forward-thinking companies are paving the way for sustainable production processes. This not only helps mitigate environmental concerns but also positions these companies as responsible corporate citizens in an increasingly eco-aware market.

To illustrate the benefits of adopting sustainable practices, consider the following bullet list:

- Reduces reliance on fossil fuel–based feedstocks

- Minimizes environmental emissions and waste

- Enhances brand reputation through commitment to sustainability

- Provides cost benefits over long-term production cycles

Companies like Genomatica and Amyris are leading the charge in this realm. Their fermentation-based production processes for chemicals like 1,4-butanediol and isoprene have reached volumes in excess of 10,000 metric tons annually, showcasing that eco-friendly alternatives can be cost-effective and scalable alternatives to traditional petrochemical routes.

The Role of Regulatory Incentives in Promoting Sustainability

Regulatory bodies also play a super important role in spurring a shift towards sustainability. As government guidelines evolve to favor eco-friendly practices, companies are increasingly aligning their products and processes with circular economy principles. These regulations are not intended to be off-putting barriers but rather serve as key drivers encouraging innovation in renewable chemistry and energy-efficient manufacturing processes.

In fact, a growing number of regulatory incentives are being introduced nationwide to foster investments in sustainable chemistry. Such initiatives are expected to boost the market’s growth by paving the way for a new generation of products that marry high performance with environmental stewardship.

Tackling Talent Shortages and the Risk of Intellectual Property Erosion

Overcoming the Talent Deficit in Advanced Process Chemistry

One of the subtle parts that continues to challenge the U.S. specialty chemicals industry is the shortage of skilled professionals in advanced process chemistry and regulatory science. The intricate and time-sensitive nature of chemical innovation demands personnel who are proficient in managing complicated pieces of production processes—from GMP validation to obtaining environmental permits.

A 2023 survey by the Chemical Processing Association revealed that nearly 44% of startups in the specialty chemicals sphere abandoned commercialization efforts due to their inability to secure qualified personnel. This talent gap poses a significant challenge, as it slows down the translation of laboratory success into mass-scale production.

The implications of this shortage are twofold. On one hand, it stalls product innovation at the pilot scale, and on the other, it increases overall costs as companies are forced to invest heavily in training and recruitment. This challenge underscores the need for academia, industry stakeholders, and government initiatives to collaborate in developing educational programs and training modules that can equip the future workforce with the skills required to work through the twists and turns of modern chemical manufacturing.

Risks Associated with Intellectual Property and Trade Secret Vulnerabilities

In addition to talent shortages, intellectual property (IP) theft is another intimidating issue that continues to cast a shadow over the specialty chemicals market. Given that these chemicals are often low-volume but high-value products, the ease with which modern analytical tools can reverse engineer complex formulations makes them prime targets for theft.

Even companies that implement strong security measures—such as restricted zones and encrypted synthesis logs—find themselves exposed when dealing with external supply chain partners and contract manufacturers. The risk of having proprietary formulations copied or exploited not only destabilizes market momentum but also creates an environment where innovation might be stifled due to fears of IP erosion.

Companies must therefore strike a balance between collaboration and control, ensuring that while they work together with partners to scale production, they do not compromise their unique product formulations. This balancing act is an ongoing challenge that calls for innovative protective measures and tighter industry standards.

Regional Trends in the U.S. Specialty Chemicals Market

Performance Spotlight: New York and California

Regional disparities in the U.S. specialty chemicals market reveal a diverse picture of industry capabilities and market dynamics. For instance, New York emerges as a powerhouse in the field, holding 15.3% of the market share in 2024. The state’s historical emphasis on pharmaceutical and fine chemical manufacturing, bolstered by decades of concentrated R&D investment and strong academic partnerships, has created an unmatched ecosystem for innovation.

New York’s regulatory expertise is another factor in its favor, with about 70% of the FDA’s inspections for novel chemical additives stemming from manufacturers based in the state. This trend solidifies New York’s position as a critical hub in the specialty chemicals domain.

California, on the other hand, distinguishes itself through niche applications and digital innovation. With approximately 68% of its specialty chemical producers using AI-driven molecular modeling tools to accelerate R&D cycles, California is at the forefront of merging technology with chemical precision. Such digital adoption not only accelerates product development but also serves as a model for how technology can enhance traditional manufacturing processes.

Comparative Overview: Regional Strengths and Opportunities

The table below provides a snapshot of key strengths observed in top-performing states:

| State | Key Strength | Market Focus |

|---|---|---|

| New York | Pharmaceutical & Fine Chemical Expertise | High-value chemical additives, compliance |

| California | Advanced digital integration | Niche applications using AI-driven R&D |

| Texas | Robust industrial base | Institutional & Industrial Cleaners |

| Michigan | Automotive manufacturing synergy | Coatings and specialty polymers |

This regional breakdown is useful not only for understanding where the market is most vibrant but also for pinpointing areas that might benefit from increased technological investment or targeted regulatory reforms.

Key Market Segments and Their Evolution

The Role of Food & Feed Additives

Among the numerous segments within the U.S. specialty chemicals market, food and feed additives currently hold a prominent 38.3% share as of 2024. The nexus between the nation’s highly processed food systems and stringent safety regulations has provided a stable platform for innovation in this sector. Companies are increasingly adopting natural alternatives, partly in response to consumer demand for clean-label products and partly due to tighter regulatory standards on chemical additives.

Recent trends in this segment include the substitution of traditional synthetic antioxidants such as BHA/BHT with plant-derived alternatives. Data from industry sources indicate that since 2021 a significant number of new snack formulations have incorporated these natural additives. This change is indicative of a broader shift towards products that balance performance with consumer safety and environmental sustainability.

The Boom in Institutional & Industrial Cleaners

The segment dedicated to institutional and industrial cleaners is set to experience a robust growth rate—projected at a CAGR of 7.9% during the forecast period. Post-pandemic heightened hygiene standards and stricter protocols from organizations such as OSHA and the CDC have forced industries to re-examine their cleaning procedures. This shift has not only elevated demand for high-quality cleaning chemicals but also led to innovations in production technology and formulation performance.

The following bullet list highlights key factors contributing to this segment’s growth:

- Mandatory disinfection protocols in healthcare and food processing industries

- The acceleration of digital monitoring solutions for quality assurance

- Increased R&D investment in formulating effective yet safe cleaning agents

- The emergence of eco-friendly and sustainable cleaning formulations

These trends reinforce the importance of the institutional and industrial cleaners segment in supporting broader public health and industrial efficiency goals.

Flavor and Fragrances: Capturing a Niche Market

Although not as dominant as the other segments, the flavor and fragrances subset within the specialty chemicals market plays a nuanced but important role. Here, the focus is on creating chemicals that add sensory appeal to products—a key consideration in the consumer packaged goods industry. The sector is experiencing innovative shifts as companies move towards natural and sustainable sources for their flavor compounds, sometimes using botanical extractions or fermentation-based methods.

Given the ultra-specific requirements in this domain, small distinctions in molecular properties can significantly impact the final product’s performance. As a result, R&D efforts in the flavor and fragrances segment often reflect a deep dive into the nitty-gritty of chemical composition and stability tests to ensure both performance and safety.

Market Strategies: Charting a Course Through Uncertain Waters

Implementing Diversified Supply Chain Techniques

Given the market’s dependency on imported raw materials, one of the most strategic responses from industry stakeholders is to diversify their supply chains. Companies are increasingly exploring partnerships with multiple suppliers across different geopolitical regions to reduce dependency on any single source. This approach not only lessens the risk of interruptions but also provides a buffer against sudden regulatory or trade policy shifts in key supplier nations.

Key supply chain strategies include:

- Establishing long-term contracts with multiple feedstock providers

- Investing in domestic production capabilities for critical raw materials

- Leveraging digital platforms to monitor global supply chain trends in real-time

- Building strategic alliances with international partners for shared risk management

Such proactive planning demonstrates that while the market is exposed to external shocks, forward-looking companies are well-equipped to steer through unexpected twists and turns.

Capitalizing on Digital and Process Innovations

Another important strategic initiative is the accelerated integration of digital tools in every aspect of production—from design and testing to manufacturing and quality control. With AI and digital modeling now central to R&D, companies are enjoying the benefits of faster iteration cycles, improved precision, and ultimately, a more resilient production process.

Embracing these digital innovations not only enhances product quality but also provides critical business insights. Companies can now get into detailed performance analytics, enabling them to fine-tune their processes, experiment with new formulations, and quickly respond to market demands. Overall, the marriage of digital prowess with chemical expertise is establishing a concrete roadmap for future growth.

Evolving Market Challenges and How to Address Them

Managing Complicated Pieces in Regulatory and Compliance Areas

While significant gains are being made in technology and product performance, the persistent issue of regulatory compliance continues to be a nerve-racking challenge for many companies. Dealing with state-specific environmental and safety rules involves sorting out multiple layers of compliance, which can sometimes impede innovation. The cost burdens associated with these measures often force companies to reallocate resources from R&D to regulatory management.

Companies need to work through these challenges by investing in dedicated compliance teams and leveraging digital tools for regulatory reporting. Additionally, policymakers can help by streamlining regulations to ease the load on manufacturers without compromising public health and environmental standards.

Addressing the Talent Gap

Finding skilled personnel to handle the demanding requirements of modern specialty chemical production is a challenge that many companies confront on a daily basis. With innovation stalling at the pilot phase because of a workforce shortage, it is super important for both industry leaders and educational institutions to collaborate. Such partnerships can help in developing specialized training programs that are in tune with the needs of today’s chemical manufacturing arena.

Key recommendations for addressing the talent gap include:

- Establishing industry-specific educational programs in collaboration with universities

- Offering apprenticeships and internships to nurture hands-on skills

- Investing in continuous professional development for existing employees

- Creating robust mentorship networks to transfer knowledge efficiently

Innovative talent development initiatives can play a pivotal role in ensuring that companies have the super important human resources needed to manage both the creative and regulatory aspects of specialty chemical production.

Mitigating Intellectual Property Risks

The threat of intellectual property theft remains a critical issue in a market where small distinctions in molecular design can make a significant impact. To address this challenge, companies must reinforce their IP protection measures while encouraging a culture of secure collaboration with partners. Advanced digital tools, coupled with stricter internal protocols, can help safeguard proprietary formulations from reverse engineering and unauthorized replication.

Some safeguard strategies include:

- Implementing state-of-the-art encryption for sensitive production data

- Regular audits of supply chain partners to ensure adherence to IP protection practices

- Developing contractual agreements that explicitly address IP rights and responsibilities

- Investing in cybersecurity measures to protect against external data breaches

With a balanced approach, companies can minimize the risk of IP erosion and continue to invest confidently in innovative research and development.

Conclusion: Looking Ahead in a Dynamic Market

In summary, the U.S. specialty chemicals market offers a dynamic and growing landscape, fueled by advancements in semiconductor production, pharmaceutical innovation, and digital transformation. While the industry is riding high on multiple growth drivers, it continues to grapple with tricky parts such as fragmented state regulations, supply chain vulnerabilities, and a shortage of skilled talent.

Opportunities, however, abound. Bio-based solutions, circular economy practices, and AI-driven discovery methods signal a promising future. With the right combination of strategic planning, robust digital integrations, and proactive regulatory reforms, the market is well-poised to handle the overwhelming challenges and make significant strides in innovation.

From the bustling hubs of New York and California to the industrial might of Texas and Michigan, the regional strengths and opportunities collectively underscore an industry that is continually evolving. While each segment—be it food and feed additives, industrial cleaners, or niche flavor and fragrance compounds—has its own set of challenges and nuanced demands, the overall picture remains one of cautious optimism.

As industry stakeholders, policymakers, and academic institutions work together to navigate the confusing bits and manage your way through the strategic hurdles, the U.S. specialty chemicals market stands as a beacon of innovation that not only drives technological progress but also supports critical sectors like semiconductors, pharmaceuticals, and sustainable manufacturing. With a clear focus on digital transformation, sustainable practices, and talent development, the road ahead looks promising.

Ultimately, success will depend on the ability to find your way through the tangled issues of regulatory complexities and supply chain uncertainties while keeping a keen eye on technological innovations and evolving consumer demands. The delicate balance between fostering innovation and managing risks is a challenge that the industry must meet head-on. Ensuring robust and resilient practices now will pave the way for sustained growth and enhanced competitiveness on a global scale.

Financial backers and industry leaders have every reason to remain optimistic. The evolving market signals that with the right strategies in place, even the more intimidating challenges can be turned into competitive advantages. For investors, the integration of AI, advancements in digital molecular design, and the push towards sustainable chemistry represent super important investment opportunities. These measures not only mitigate risk but also offer clear avenues for growth in an industry built on precision and innovation.

In essence, the U.S. specialty chemicals market is a microcosm of modern industry: advanced yet vulnerable, full of promising opportunities yet loaded with issues that require thoughtful management. For those invested in the market—from business leaders and policymakers to innovators and academic professionals—the path ahead is one that will demand strategic foresight, collaborative problem-solving, and unwavering commitment to quality and sustainability.

As the market continues to mature, the ability to steer through its many twists and turns will ultimately define those who lead the charge. With regulatory reforms clarifying ambiguous bits, with technological advances creating new products at an unprecedented pace, and with a sustained focus on overcoming talent shortages, the future of the U.S. specialty chemicals market looks set to continue its steady ascent.

This opinion editorial serves as a call to arms for all stakeholders to embrace both the promising opportunities and the complicated pieces that define the industry. By investing in cutting-edge research and developing adaptive business strategies, participants in this market can ensure that they remain at the forefront of innovation while effectively managing the many challenges ahead. In the end, the path forward is clear: synergy between technology, sustainability, and strategic talent investments will be the key to unlocking the full potential of the U.S. specialty chemicals market.

Originally Post From https://www.marketdataforecast.com/market-reports/us-specialty-chemicals-market

Read more about this topic at

Specialty Chemicals Market Size & Share Report, 2030

Specialty Chemicals Market, Industry Size Forecast [Latest]