Thermal Interface Materials Fuel Electric Vehicle Revolution Toward an Eight Point Nine Billion Market by 2035

Thermal Interface Materials: A New Era in Electronic and Automotive Innovations

The thermal interface material (TIM) market is experiencing an exciting transformation driven by advances in electronics, automotive design, and industrial manufacturing. Over the next decade, the market is projected to nearly triple in size, underscoring the increasing significance of effective heat management solutions in an era of rapid technological progress.

In this opinion editorial, we take a closer look at how TIMs are reshaping critical industries, examine why advanced thermal management is now a key factor for manufacturers globally, and explore what the future holds for those offering these state-of-the-art products. With an estimated growth from USD 3.2 billion in 2025 to USD 8.9 billion by 2035, this sector is set for substantial expansion.

Understanding the Growth Trajectory of Thermal Interface Materials

The global TIM market is on a robust growth path, fueled by the escalating need to manage heat in ever-smaller, faster, and more powerful electronic devices. As the industry witnesses an increased demand for high-performance electronics and EV batteries, the physical properties of TIMs become super important.

Several factors fuel this expansion:

- Miniaturization: Devices are getting smaller, making efficient heat dissipation a tricky part of product design.

- Performance: Demanding applications such as electric vehicles and AI processors require materials that can handle intense, localized heat without failure.

- Innovation: Advances in material science, including silicone-based and graphene-enhanced compositions, are paving the way for new product lines that tackle the most tangled issues in thermal management.

Between 2025 and 2030, the market is set to gain approximately USD 1.9 billion—a growth that speaks not only to the solid fundamentals of the sector but also to the critical role that TIMs play in making everyday technology more reliable.

How EV Growth is Reshaping the TIM Landscape

One of the biggest drivers of this market’s growth is the accelerating adoption of electric vehicles (EVs). As automotive systems evolve, the need for enhanced battery performance and better overall thermal regulation becomes super important. EV batteries generate significant amounts of heat, and if this heat is not managed properly, performance issues and safety risks may emerge.

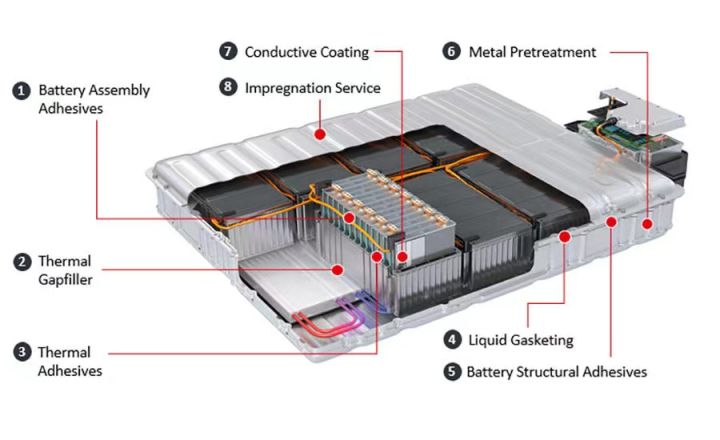

Electric vehicles are now at the forefront of technological evolution in transportation, and TIMs are central to their success due to:

- Battery Thermal Management: Advanced TIMs reduce the risk of overheating in EV batteries, thereby extending their lifespan and ensuring safer operations.

- Efficiency in Power Control Systems: TIMs are indispensable in managing the heat in power modules, an increasingly challenging bit as vehicle electronics become more compact and powerful.

- Innovation in Materials: Companies are investing in next-generation materials that meet the nerve-racking demands of electric vehicle applications, such as graphene-enhanced products that promise superior conductivity.

The fusion of automotive innovation and specialized materials is a combination that steers through many of the hurdles created by the tricky parts of high-performance engine and battery systems.

Silicone-Based Materials: The Cornerstone of TIM Dominance

An intriguing aspect of the TIM market is the dominance of silicone-based materials, which currently capture a remarkable 41% of the market share. These materials shine because of their exceptional thermal conductivity, stability, and reliability across both electronics and automotive systems.

There are several reasons why silicone-based TIMs are the go-to option for manufacturers facing complicated pieces of thermal management challenges:

- Superior Conductivity: They excel at dissipating heat, which is essential in high-density applications where every degree matters.

- Temperature Stability: Their ability to perform under a wide range of conditions makes them suitable for both small-scale electronics and larger automotive systems.

- Consistency: Their ease of integration with automated dispensing systems simplifies production processes, even when sorting out multiple production stages.

Other composition types, such as epoxy-based and polyimide-based materials, are also on the radar. Epoxy-based TIMs, with a 25% market share, are appreciated for their strong adhesive properties and affordability. Meanwhile, polyimide-based materials, which hold 18% of the market, are favored in high-temperature aerospace and challenging automotive applications.

Product Segmentation: Thermal Pads, Greases, and Beyond

Thermal management solutions come in various forms, each adapted to specific needs. Among these, thermal pads stand out as the fastest-growing segment and now maintain 35% of market usage. Their ease of application and stability make them a prime candidate for mainstream electronics and LED systems.

Here’s a closer look at key product categories:

- Thermal Pads: Valued for their plug-and-play qualities and stable performance; they’re essential in mass-manufactured electronics systems.

- Thermal Greases and Adhesives: Commanding roughly 38% of the market, these products are critical in settings like CPUs and power modules where rapid heat conduction is necessary.

- Gap Fillers: Accounting for 22% of usage, these products are widely used in EV battery configurations and power control frameworks, where filling small air gaps efficiently is one of the little details that matter.

- Phase Change Materials: Although currently smaller at 14%, these materials are expected to gain traction as computing and 5G applications demand precise heat control.

A table outlining these product categories provides a quick overview:

| Product Type | Market Share | Main Applications |

|---|---|---|

| Thermal Pads | 35% | Electronics, LED systems |

| Thermal Greases & Adhesives | 38% | CPUs, power modules |

| Gap Fillers | 22% | EV batteries, power control |

| Phase Change Materials | 14% | Data centers, high-performance computing |

These details underline that every product segment is addressing specific, sometimes very intimidating, challenges related to heat management in modern devices.

Breaking Down Regional Trends in the TIM Market

The TIM market’s expansion is not uniform worldwide. Different regions showcase distinct growth vectors based on local manufacturing strengths and industry demands.

Asia Pacific: The Global Growth Powerhouse

Asia Pacific stands out as the central hub of TIM market revenue, contributing nearly 50% of global sales. With major manufacturing powerhouses in China and India, the region leads the charge in electronics production and EV manufacturing. The trickier parts for these countries include managing rapid production scale-up and ensuring quality in a highly competitive market.

Key factors in APAC’s rise:

- China’s impressive 11.3% compound annual growth rate (CAGR) reflects aggressive investments in electronics and EV sectors.

- India’s stable 10.7% CAGR is driven by automotive electrification and cost-effective manufacturing practices that are slowly becoming the global norm.

These economies are making strides by focusing on next-generation materials like high-conductivity silicone and graphene-enhanced products that address the little twists and turns of thermal management in high-speed manufacturing.

Europe: Embracing Automotive Precision and Sustainability

Europe’s TIM market, although smaller in absolute terms compared to Asia Pacific, is marked by an emphasis on automotive precision and sustainability. Valued at USD 0.9 billion in 2025 and forecast to reach USD 2.1 billion by 2035, the growth here underscores the importance of managing the overbearing heat challenges in advanced automotive applications.

Key highlights include:

- Germany’s leadership with 31.2% market share, supported by its longstanding tradition of automotive engineering excellence and stringent reliability standards.

- Strong contributions from the UK, France, and Italy, where manufacturers are innovating with non-silicone formulations and phase change materials to align with sustainability and recycling goals.

In many ways, European companies are taking the wheel in developing REACH-compliant solutions that are not only effective in dissipating heat but also environmentally responsible—a super important consideration for modern businesses.

United States: A Hub of Premium Innovation

The United States is another significant player in the TIM landscape, where the market is growing at a respectable 8.6% CAGR. American innovation is seen particularly in high-purity silicone greases and metal-based TIMs that cater to premium-grade applications—ranging from EVs and data centers to defense electronics.

Important U.S. trends include:

- Ongoing investments in R&D especially in states such as California, Texas, and Michigan.

- A strong focus on quality and performance that meets the rigorous standards demanded by technologically advanced applications.

Manufacturers in the U.S. are working through the tangled issues of industrial quality control and product standardization, ensuring that their products perform reliably even under the most challenging operational conditions.

Saudi Arabia: The Emerging Middle Eastern Thermal Hub

Saudi Arabia is gradually establishing itself as a growing market for advanced thermal management solutions. The nation’s Vision 2030 has spurred local investments in electronics assembly and high-tech infrastructure projects, leading to an expected CAGR of around 7.9%.

This shift is visibly moving the region away from its traditional areas of focus towards new, innovation-driven sectors. Key aspects here include:

- Government-backed initiatives spearheading the adoption of metal-based TIMs and cutting-edge silicone materials.

- Efforts to team up with global manufacturers to boost domestic production capabilities and meet local demands in energy storage and automotive grade products.

The implications of this regional shift are significant, as it not only broadens the geographical scope of TIM influence but also diversifies the industry’s approach to handling intricate pieces of advanced manufacturing.

Competition and Innovation: Who’s Leading the Charge?

A look at the competitive landscape reveals a space that is moderately consolidated but still ripe for strategic moves and innovation. The top players in the market not only hold substantial market shares but are also investing in research that targets the fine points of thermal management.

Key industry players include:

- Henkel AG & Co. KGaA – Commanding an 18% market share with products noted for high conductivity and consistent quality.

- 3M Company, The Dow Chemical Company, Honeywell International, and Parker Hannifin Corporation – These companies are known for integrating graphene and other advanced materials into their product lines, addressing the subtle parts that make all the difference.

- Other notable players include Shin-Etsu Chemical Co., Indium Corporation, Momentive Performance Materials, and Laird Performance Materials – All are actively working to figure a path through the maze of ever-changing performance standards.

These companies are not just focused on the present challenges but are also investing in future-proofing their products. This strategic focus involves:

- Developing nano-enhanced materials that can address the nerve-racking heat dissipation demands of next-generation electronics.

- Exploring new methods of automated application which simplify the process of integrating TIMs into complex systems.

- Strengthening research initiatives that target both the quantitative and qualitative improvements of thermal management solutions.

In an industry where advances are measured in fine shades of improvement, every incremental gain can be super important—not only for the bottom line but also for long-term technological advancement.

Adapting to the Tricky Parts of Modern Thermal Management

Although the growth projections are inspiring, the TIM market is also loaded with issues that require careful thought. Manufacturers must address a host of intimidating challenges ranging from quality assurance to scalability issues in automated production lines.

Here are some of the most pressing challenges:

- Quality Consistency: In high-performance applications, even slight differences in material performance can have outsized effects. This is why producers are challenged to maintain consistent quality across bulk production runs.

- Integration with Automated Systems: As production lines become more streamlined, ensuring that TIMs integrate perfectly with automated placement and dispensing systems is a tricky part many companies face.

- Adapting to Changing Standards: Regulations and standards are continually evolving, making it necessary for manufacturers to keep abreast of every twist and turn in compliance requirements.

The industry must figure a path that balances innovation with the practical realities of mass production. While these issues might appear overwhelming at first glance, continuous improvements and robust R&D efforts are slowly chipping away at these barriers.

It is a constant dance—a combination of addressing the hidden complexities of material science and working through production challenges that can sometimes seem as tangled as they are intriguing.

Future Trends: What Lies Ahead for TIMs?

Looking forward, several trends are set to shape the thermal interface material market over the next decade. With the rise of AI-driven manufacturing, IoT devices, and next-generation computing, the need for enhanced thermal management will only intensify.

Some key future directions include:

- Greater Adoption of Nano-Enhanced Materials: Future TIMs will likely incorporate advanced nanotechnology to further improve thermal conductivity and efficiency. These materials are expected to play a critical role in sectors such as data centers and high-performance computing.

- Integration with Smart Systems: Automation in manufacturing is evolving, and TIMs that work seamlessly with smart production lines will be highly sought after. This means that innovations must not only improve performance but also ease of integration.

- Eco-Friendly Formulations: As global emphasis on sustainability increases, manufacturers are expected to innovate in the realm of environmentally friendly TIMs. These products will be developed with a focus on recyclability and reduced toxin output while maintaining performance.

A roadmap for future product development might look like the following table:

| Future Trend | Applications | Expected Benefits |

|---|---|---|

| Nano-Enhanced TIMs | Data centers, High-performance computing | Improved conductivity, better durability |

| Smart Integration Solutions | Automated manufacturing, IoT devices | Simplified application, precision performance |

| Eco-Friendly Formulations | Automotive, Consumer electronics | Sustainability, regulatory compliance |

These forward-looking trends point to a future where thermal management is not just a supporting technology but a core component of product excellence. Companies that take a closer look at these developments and adapt early are likely to enjoy substantial competitive advantages.

Strategic Implications for Manufacturers and Investors

The evolving landscape of thermal interface materials carries significant strategic implications. For manufacturers, understanding the market dynamics means being prepared to invest in R&D to improve product efficacy, address hidden complexities, and respond swiftly to regulatory changes. Investors, on the other hand, should view this market as a promising growth area, given the robust CAGR rates and the central role TIMs play in emerging sectors like electric vehicles and high-performance computing.

Some strategic takeaways include:

- Focus on Quality and Scalability: Manufacturers must ensure that their production processes can manage the confusing bits of scale without compromising quality.

- Embrace Innovation: Investing in new technologies such as graphene-enhanced TIMs can lead to breakthroughs that address both performance and cost challenges.

- Global Expansion Strategies: With regions like Asia Pacific and Saudi Arabia emerging as high-growth areas, companies must consider localized production and strategic partnerships to better serve these markets.

- Monitoring Regulatory Trends: Understanding and adapting to changing standards is super important to avoid any off-putting hurdles in the product certification process.

Both manufacturers and investors should take a closer look at these strategic shifts. Not only do these trends help in managing the nerve-racking aspects of production and compliance, but they also open up new avenues for growth and market expansion.

The Role of Innovation in Overcoming Production Challenges

As the TIM market matures, one of the most exciting aspects is the continuous journey of innovation. This journey involves overcoming the complicated pieces of old production methods and integrating more efficient, automated processes that can handle increased demand.

Innovation is the catalyst that enables companies to:

- Introduce novel materials such as phase change compounds and advanced epoxies that handle high temperatures with ease.

- Integrate smart manufacturing technologies that allow for precise application of TIMs in complex systems.

- Reduce production costs while improving overall performance, making adoption of these materials super important even for companies with tight margins.

By investing in innovation, companies can effectively figure a path through the numerous twists and turns of modern manufacturing, increasing both the reliability and performance of their thermal management systems.

Concluding Thoughts: A Future Shaped by Heat Management Excellence

The story of thermal interface materials is a vivid reminder that sometimes the most essential components in technology are the ones hidden in plain sight. They do not always grab headlines, but their role in ensuring that our devices—and by extension, our daily lives—run smoothly cannot be overstated.

From the rapid evolution of EVs to the continuous miniaturization of electronic devices, the need for effective thermal management has become super important. As manufacturers navigate the tangled issues of quality control, integration with automated systems, and meeting evolving regulatory demands, one thing remains clear: those who master the fine points of effective heat management will be the leaders of tomorrow.

Moreover, the optimistic growth projections of the TIM market, backed by robust CAGR and increased investment in high-performance materials, make it an attractive field for both manufacturers and investors alike. Whether you are directly involved in production or strategically planning your next business move, the message is clear—a deep understanding of thermal interface materials is crucial to staying competitive in today’s fast-paced, ever-evolving technology landscape.

By continually investing in research and actively managing the more confusing bits of production and market unpredictability, the TIM industry is not only solving today’s pressing challenges but also setting the stage for a future defined by technological excellence and innovation.

In conclusion, as we take a closer look at the next decade, it is evident that thermal interface materials will play a super important role in shaping the future of electronics, automotive systems, and industrial manufacturing. Their evolution is a testament to the power of focused, strategic innovation—a path that manufacturers and investors must be ready to take if they are to thrive in a world where every fraction of a degree counts.

Ultimately, the journey ahead involves not just managing heat, but redefining the very parameters of performance. The ability to get into the heart of thermal management—addressing every subtle detail with precision—will determine the difference between companies that follow the market and those that lead it. For those prepared to embrace the challenge, the future truly is bright and promising.

Originally Post From https://www.einpresswire.com/article/865312043/thermal-interface-material-market-to-hit-usd-8-9-billion-by-2035-driven-by-ev-growth-across-apac-europe-usa-ksa

Read more about this topic at

Revolutionizing personal thermal management …

Graphene & Carbon Fiber: Revolutionizing Thermal …