Unlocking Global Energy Trends and Saudi Investment Ambitions with Zak Brown

Sustainable Energy Investments in Saudi Arabia’s Emerging Tech Market

The global economy is in the midst of a transformation where energy investments and technology infrastructure are taking center stage. Recent discussions on Bloomberg reveal that Saudi Arabia, traditionally known for its oil wealth, is embarking on a daring pivot toward becoming a high-tech hub. This shift is not merely a rebranding exercise; it is a full-scale repositioning aimed at developing an economy that leverages digital infrastructure, renewable energy, and innovative technology. Saudi Arabia’s Vision 2030 is a key driver of this change as it charts a course away from oil dependence.

In practical terms, the Kingdom is building critical systems around data centers, AI networks, and e-sports platforms. This strategic move underlines the necessity to build a robust digital ecosystem that can support high-demand applications, from artificial intelligence to massive online gaming events. While fossil fuels will likely continue to play an essential role in the short term, the long-term goal is clear: to diversify the economy and build new pillars of prosperity.

Stakeholders from across the global investment community are watching carefully as Saudi Arabia invokes its energy reserves not simply as a means to generate revenue but as a way to provide the low-cost power infrastructure essential for modern tech ventures. The benefits of such an approach include the ability to offer less expensive electricity to industries and consumers alike, further spurring economic activity in both the local and global markets.

Behind this shift lies an embrace of technology that ensures energy is not wasted but optimized. As AI adoption accelerates worldwide, the demand for sustainable and cost-effective energy sources is also rising. Saudi Arabia is poised to step up as a key supplier in this new technological ecosystem, setting the stage for a reimagined global economy.

Building a Winning Culture: Lessons from McLaren’s Zak Brown

In a related strand of business innovation, automotive racing—and specifically the story of McLaren Racing—provides crucial insights into leadership and the cultivation of competitive excellence. McLaren’s CEO, Zak Brown, who once was a rebellious teenager in California, now heads one of the most respected teams in international auto racing. His journey underscores how personal reinvention and relentless ambition can shape outstanding business practices.

Brown’s approach is deeply rooted in the idea of fostering a winning culture. For him, leadership is not about resting on past glories but about consistently pushing the envelope, demanding improvement even when success is already on the table. The philosophy at McLaren emphasizes a few key elements that can be applied to various sectors: embracing innovation, taking calculated risks, and always being on the lookout for that extra advantage in performance.

To understand what makes a winning culture, consider these bullet points:

- Emphasizing continuous improvement and agile responses to challenges.

- Encouraging a mindset where every team member feels empowered to contribute innovative ideas.

- Investing in cutting-edge technology and training programs that prepare talent for the future.

- Building resilient business models that can shift fluidly amidst market fluctuations.

For many in the automotive industry—and indeed many startups in other sectors—the story of McLaren Racing sends a clear message: leadership is as much about personal transformation as it is about driving industry innovation. Zak Brown’s experience illustrates that by steering through the twists and turns of a competitive market, companies can unlock unexpected potentials and create opportunities that go beyond the racetrack.

Community Investment and Philanthropy: The Hidden Capital of American Generosity

Across the United States, a quieter revolution is unfolding, one that centers on community investment and the power of philanthropy. From the boardrooms of major corporations like Walmart to the small-town settings in Michigan, American generosity has emerged as a silent engine of economic growth and social vitality. Stories such as those featured in Bloomberg’s coverage of America’s most charitable counties serve as a reminder that hidden donations and community engagement can have ripple effects throughout the national economy.

This trend is particularly significant in an era where income inequality and fiscal uncertainty often dominate economic discussions. The robust philanthropic spirit in various states underscores a unique blend of corporate corporate responsibility and grassroots organizing. Many small businesses, nonprofits, and even local governments rely on these gestures of goodwill to fill funding gaps, create social programs, and stimulate local economies.

Organizations and community leaders are increasingly using data to fine-tune their initiatives, ensuring that funds are allocated to the most impactful projects. With technology now enabling a more precise analysis of social needs, philanthropic efforts are becoming better targeted and more strategic. Observers note that this proactive approach to giving makes it much easier for communities to figure a path toward sustainable growth while also addressing some of the more tangled issues of socio-economic inequity.

Consider some key approach areas in community investment:

- Using data analytics to target local needs and measure impact effectively.

- Encouraging partnerships between local businesses and charitable organizations.

- Developing long-term strategies that combine corporate resources with community ambitions.

- Fostering volunteerism and social capital that enhance community resilience.

In this regard, the hidden capitals of American generosity are proving to be much more than fleeting moments of charity—they are essential building blocks for a more resilient and inclusive economy.

Rebalancing Oil Revenues: Diversification in an Uncertain Fiscal Environment

One of the most intriguing obstacles faced by Saudi Arabia in its transition is the challenge of rebalancing revenue streams that have long relied on oil. The task of shifting away from fossil fuels is not without its nerve-racking moments, as the country navigates through a maze of uncertain fiscal policies and external market pressures. Suppressed oil prices have already led to cutbacks in several mega projects, forcing the Kingdom to narrow the scope and scale of its ambitions.

Nevertheless, this push for diversification is also a promising avenue for learning and adaptation. While the oil sector continues to provide a reliable stream of funds, the reallocation of these resources into technology and sustainable energy presents multiple opportunities. For investors, this signals the onset of a broader economic experiment—one that requires steering through tricky parts and tangled issues.

Some essential strategies for managing this complex transition include:

- Prioritizing expenditure on projects with high long-term payoffs rather than short-term visibility.

- Investing in local talent and indigenous technology start-ups to build capacity from within.

- Reducing reliance on expensive external consultancy services by developing internal expertise.

- Striking a balance between maintaining a stable oil economy while experimenting with new economic models.

This push for diversification is a clearly one of the most super important strategic moves in global economics today. By making tough choices and reinforcing internal resources, Saudi Arabia is learning how to find its way amid a network of economic challenges. The success of this initiative will depend on the Kingdom’s ability to manage the little details of budget allocation and technology adoption, along with its broader geopolitical ambitions.

Tech-Driven Infrastructure: Building a Foundation for a Digital Future

The interplay of technology and infrastructure is critical to realizing the ambitions of countries like Saudi Arabia and industries around the globe. In order to build an AI network capable of powering e-sports, data centers, and large-scale digital applications, it is necessary to construct a supportive tech-driven infrastructure. This means not only investing in new hardware and software, but also fostering an environment where innovative mindsets become the norm.

Many investors and tech experts emphasize that the ability to build out a dependable infrastructure is a must-have in the age of digital transformation. Achieving this goal often involves a detailed inspection of operational processes, supply chains, and logistical networks, all of which must be optimized to handle the large-scale demands of modern technology.

Some key aspects include:

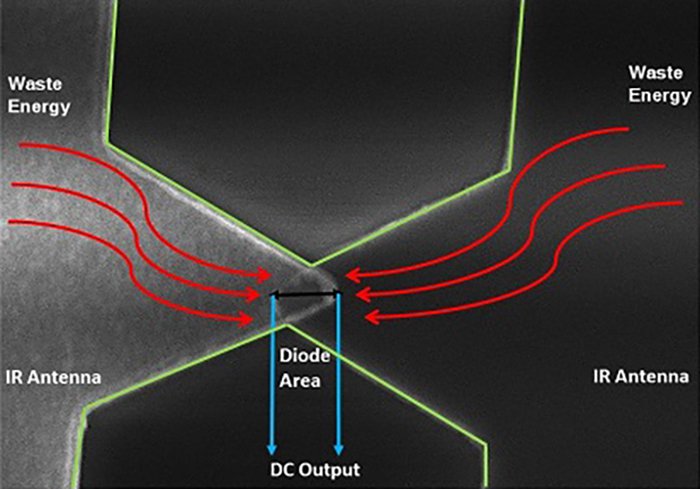

- Energy Efficiency: Establishing frameworks to ensure that low-cost and sustainable energy sources are available for technology hubs.

- Advanced Data Centers: Upgrading and expanding the capacity of data centers to host ever-growing streams of digital content and applications.

- Green Technology: Integrating renewable energy solutions alongside traditional power systems to ensure environmental sustainability.

- Connectivity Solutions: Building out comprehensive telecommunication and Internet infrastructure capable of supporting next-generation applications.

By combining these elements in a cohesive strategy, nations can unlock the potential of their economies and make the most of the endless opportunities afforded by modern technology. It is a fascinating journey that requires cooperation between government, industry, and the public to achieve full-scale transformation.

Investing in Innovation: The Role of Strategic Partnerships

The importance of working through complex economic changes through strategic partnerships cannot be overstated. As seen in the recent high-profile visit of Saudi Arabia’s Crown Prince Mohammed bin Salman to Washington, international collaborations are increasingly becoming the cornerstone of global investment strategies. These high-stakes meetings are less about ceremonial fanfare and more about establishing mutual trust between nations and corporations alike.

Meetings, such as the one highlighted by Bloomberg, serve to articulate a mutual commitment to diversified growth. When leaders from both sides come together, they illustrate how investment capital can flow in a reciprocal manner—from traditional oil investments to technology and digital ventures.

A closer look at these partnerships reveals several benefits:

- Mutual knowledge exchange, where each party can learn from the other’s experiences in dealing with tricky parts of economic shifts.

- The development of comprehensive market strategies that integrate traditional practices with modern technologies.

- Opportunity to solve complicated pieces of infrastructure challenges by leveraging expertise from both developed and emerging markets.

- Enhancement of economic stability as diversified investments provide a safety net against market volatilities.

These strategic partnerships are emblematic of a broader global economic shift where interdependency is seen as a strength in a rapidly changing world. Investors who are keen to dig into emerging markets must take note of these subtle details, as they often determine the quality and longevity of cross-border collaborations.

Small Business and the Ripple Effects of Global Economic Shifts

Even as global titans maneuver through intricate international policies and mega projects, small businesses remain at the heart of economic transformation. In many ways, the rise of high-tech hubs and the rebalancing of global energy portfolios indirectly influence local enterprises. Small business owners and local manufacturers may find themselves in a position to benefit from a surge in new infrastructure projects and increased consumer spending driven by innovative partnerships.

For example, the rollout of smart cities and sustainable infrastructure projects not only promises job creation but also opens up opportunities for local suppliers to contribute to large-scale innovations. The flow-on effects from these major policy changes often leave behind a trail of improved services and increased demand for locally sourced materials. As global investors steer through the nerve-racking demands of international politics, small businesses can adapt by retooling their operations to meet new standards in quality, efficiency, and sustainability.

Some key considerations for small businesses amidst this backdrop include:

- Adopting Sustainable Practices: Integrating green methodologies within daily operations can position small companies as leaders in environmental responsibility.

- Investing in Digital Tools: Embracing technology—from cloud computing to data analytics—can help streamline processes and improve competitiveness.

- Leveraging Community Networks: Tapping into local philanthropic networks can provide both financial and operational support during transitional periods.

- Collaborative Innovation: Engaging in partnerships with larger corporations or tech firms can open up opportunities for knowledge exchange and resource sharing.

The ripple effects from international shifts in energy and tech investments are far-reaching. They remind small business owners that while the global economic chessboard is complex and occasionally intimidating, there are always ways to find your way through by focusing on agility, innovation, and community support.

Marketing Strategies in the New Economic Landscape

In today’s fast-changing economy, effective marketing strategies are more critical than ever. As companies in both the tech and traditional sectors recalibrate their business models to adapt to new market realities, marketing has emerged as an essential tool in reaching audiences that span from local communities to global investors. The shifting dynamics in digital and traditional media demand an approach that appreciates both the fine points of social engagement and the broad strokes of economic branding.

Marketers now face a number of little twists when it comes to promoting their products and services in this ever-evolving environment. On one hand, there is the challenge of maintaining brand authenticity amid rapid digital transformation. On the other, businesses must also consider how best to highlight their contributions to major structural shifts in areas such as sustainable energy and technological infrastructure.

Key elements of a modern marketing strategy include:

- Data-Driven Storytelling: Utilizing data to craft compelling narratives that resonate with customers across demographics.

- Digital Engagement: Leveraging digital platforms for real-time interaction and customized messaging that reflect community values and technological innovation.

- Multi-Channel Outreach: Integrating both classic media channels and cutting-edge digital tools to build a robust, omnichannel presence.

- Transparency and Trust: Emphasizing genuine corporate social responsibility in messaging helps to bridge the gap between large-scale economic shifts and local consumer trust.

These marketing strategies dovetail nicely with broader economic shifts. They ensure that the narrative of transition—whether it is a shift to sustainable energy, diversification of revenue streams, or the emergence of digital infrastructure—is communicated thoughtfully and effectively to both stakeholders and everyday consumers.

Overcoming the Confusing Bits of Global Economic Policy

The current global economic landscape is layered with confusing bits when it comes to policy implementation. From the intricate decisions made in Washington to the ambitious yet challenging projects in Saudi Arabia, there are plenty of twists and turns for investors, policymakers, and business leaders alike. International relationships and the terrain of business tax laws further complicate the picture, layering each decision with potential risks and rewards.

Much of the uncertainty comes from trying to find pathways through policies that are as old as the industries they aim to regulate. However, there is hope on the horizon as governments and private entities work together to smooth over these tangled issues. Regulatory bodies are beginning to incorporate modern best practices, and new frameworks are emerging to support innovation while protecting consumer interests and ensuring competitive fair play.

To break down the challenges of global economic policies, consider the following table summarizing common issues and potential approaches:

| Issue | Potential Approach |

|---|---|

| Outdated Regulatory Frameworks | Modernize policies with expert input and flexible guidelines |

| Over-reliance on Fossil Fuels | Reinvest in renewable energy projects and diversify revenue sources |

| Confusing Tax Laws | Simplify and harmonize business tax regulations to attract investments |

| High Barriers to Innovation | Create incentive programs that reward research and development |

This synthesis of issues and solutions represents steps toward figuring a path through the current maze. By anchoring policy decisions in clear, actionable strategies, both developed and emerging economies can work together to ease the nerve-wracking journey of global economic reform.

International Investment: Shaping the Future with Cross-Border Collaborations

Global capital flows are experiencing a notable transformation. In recent events, such as the groundbreaking visit of the Saudi Crown Prince to Washington, discussions have been tinted with the promise of up to $1 trillion in investments from Saudi Arabia into the United States. This event underscores a mutually beneficial arrangement wherein Western capital could increasingly find a home in dynamic, tech-driven projects backed by Middle Eastern resources.

The implications for international investment are as broad as they are deep. Investors are increasingly required to figure a path that includes dealing with confusing bits of regional politics, overcoming intimidating regulatory environments, and engaging with partners to create stable, diversified portfolios. Clearly, the era of isolated national economies is coming to an end, replaced by a more integrated model of cross-border capital flow.

Key benefits and challenges of such collaborations include:

- Benefits:

- Access to new markets with advanced technology and abundant resources.

- Enhanced diversification of investment portfolios reducing dependence on traditional sectors.

- Opportunities for joint ventures that combine local insights with international capital.

- Challenges:

- Understanding and working through local laws and business tax regulations.

- Mitigating the risks associated with volatile energy markets and fluctuating oil prices.

- Aligning strategic visions between culturally diverse partners.

For many investors, the path forward includes a mix of traditional diligence and a readiness to work through nerve-wracking uncertainties. By engaging with cross-border partners and adapting to the subtle details of international business policies, they can embrace an era marked by both promise and risk.

Adapting to a Changing World: Lessons for Business Leaders

Business leaders across industries—from small business owners to executives at global conglomerates—must continuously adjust their strategies in response to shifting economic tides. The evolving narratives in Saudi Arabia’s massive infrastructure plans, changes in global energy investments, and the reinvention of leadership models in auto racing serve as compelling case studies. Each example brings with it important lessons on flexibility, innovation, and proactive change.

Here are some key takeaways for leaders looking to work through the challenging parts of economic transformation:

- Flexibility is Key: In an environment riddled with problems, the ability to quickly adapt to new circumstances is a critical success factor.

- Invest in Talent: Whether it’s in tech, manufacturing, or services, nurturing talent from within helps build resilient organizations.

- Leverage Strategic Partnerships: Collaboration between governments and private enterprises can unlock powerful synergies that overcome complicated pieces of market challenges.

- Embrace Innovation: Leaders must remain on the lookout for innovative solutions that address the hidden complexities of both modern infrastructure and legacy business practices.

These lessons are super important not only for survival in a competitive global landscape but also for cultivating long-term growth. As trends shift and technological advancements evolve, the need to find your way through emotional as well as strategic reform becomes more pressing than ever.

Looking Ahead: The Future of Global Investment and Economic Diversification

As we project into the next decade, the landscape of global investment looks set to change radically. The intertwined journeys of small business innovation, automotive leadership exemplified by figures like Zak Brown, and the sweeping economic reforms in Saudi Arabia all offer a glimpse at a future where the boundaries between technology, energy, and traditional sectors blur.

The move toward diversified revenue streams is not without its intimidating twists and turns. Pressure on traditional markets compels both governments and private investors to dig into new areas, quickly reworking old frameworks to make room for emerging sectors. With the digital transformation accelerating and sustainable energy demands mounting, the world is witnessing an economic evolution that is both dynamic and unpredictable.

Looking ahead, several trends are poised to define this new era:

- The Rise of Renewable Energy: Even as fossil fuels remain relevant, renewable sources are increasingly becoming a central pillar in global energy strategies.

- Tech Infrastructure as a Global Priority: From advanced data centers to expansive AI networks, building technological foundations will be key to economic resilience.

- Sustained Community Engagement: The role of local philanthropy and small business contributions will continue to serve as a bedrock for economic stability, particularly in times of rapid change.

- Cross-Border Collaborations: Enhanced dialogue between nations on investment, trade, and regulatory standards is likely to pave the way for future growth.

Each of these trends reflects a broader shift in how global capital is deployed and how economies are structured in the 21st century. Leaders—from big industry players to local entrepreneurs—will need to constantly figure a path through a maze of evolving policies, market demands, and technological breakthroughs. The ability to steer through these nerve-wracking challenges will define the economic successes of tomorrow.

Conclusion: Embracing a Multi-Faceted Future in Business and Technology

The overarching narrative within today’s business world is one of adaptation and reinvention. Be it through the ambitious diversification plans heralded by Saudi Arabia’s Vision 2030, the innovative leadership on display in the world of motor racing, or the quiet yet powerful engine of community philanthropy in America—each facet points toward a future defined by collaboration, innovation, and resilience.

There are no simple solutions to the tricky parts of economic transformation. Instead, the way forward lies in actively managing your way through the complicated pieces of policy, technology, and market dynamics. Leaders must stay agile, sensitive to the subtle details of change, and ready to take the wheel in steering their organizations towards sustainable growth.

In a world where every decision is loaded with issues and every investment carries both promise and risk, finding creative ways to connect disparate elements is critical. The future belongs to those who can blend traditional strengths with new-age innovations, patiently building bridges between old revenue streams and dynamic, tech-driven initiatives.

Ultimately, whether you are a small business owner, an industrial manufacturer, or a member of a multinational team navigating global investments, the key lies in recognizing that change is inevitable. By embracing a mindset that is open to learning, continuously improving, and leveraging both local and international partnerships, every stakeholder can contribute to a more vibrant, diversified, and sustainable economic future.

The journey ahead may be filled with unexpected twists and turns, but with clear vision, strategic partnerships, and a commitment to purposeful innovation, the roadmap of tomorrow stands ready for those brave enough to take a closer look. As the world gradually transforms itself by rebalancing old revenue models and investing in new, digital infrastructures, every careful step today builds the foundation for a promising and prosperous future.

Originally Post From https://www.bloomberg.com/news/videos/2025-11-22/wall-street-week-saudi-foreign-investment-zak-brown-video

Read more about this topic at

In charts: 7 global shifts defining 2025 so far

Global Economic Outlook Shows Modest Change Amid …